When I say, “3.5 months of labor,” I’m not actually referring to the work we do here in our Louisville tax office on behalf of our clients. (Frankly, we work the entire year so that these past few months would NOT be as crazy as they might otherwise be.)

Nope, I’m referring to one of the big dates we mark every year around here: “Tax Freedom Day“. It’s the date when the nation as a whole* has earned enough money to pay its total tax bill for the year.

(*I say “as a whole”, because this is only a collective average and does not accurately reflect the number for you or for your neighbors — it is the average tax burden for the overall economy, rather than for specific subgroups of taxpayers.)

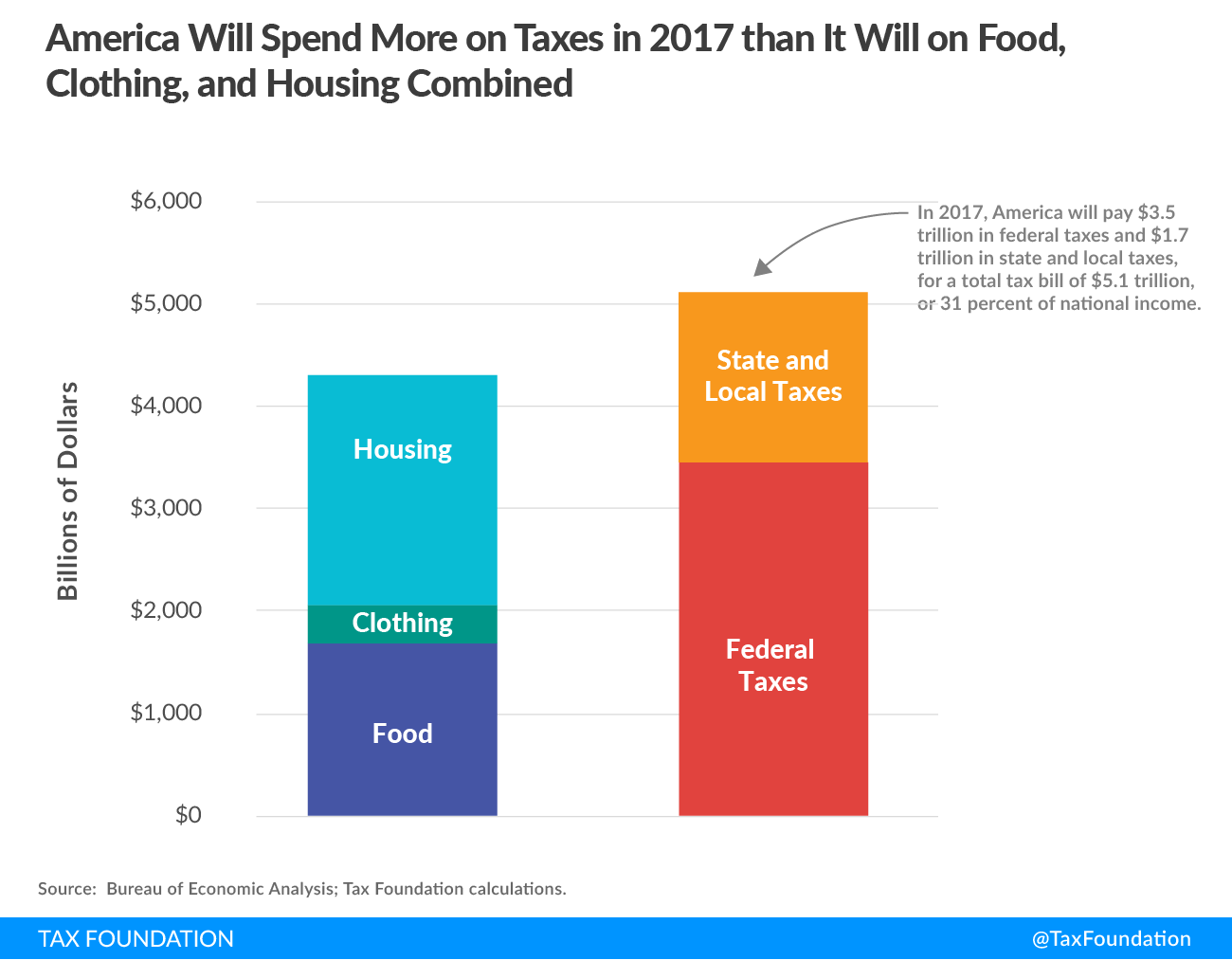

This year’s magic date was Sunday, April 23, 2017 (which is one day earlier than last year, for what it’s worth). 3.5+ months into the year. And, as in years past, Americans will collectively spend more on taxes in 2017 than they will on food, clothing, and housing combined.

That’s a sobering reality — but for me and my team, it is a helpful reminder for why we do what we do: We are about keeping your tax bill as low as legally and ethically possible.

Now, with that aside, if work on your return has been completed and you are not on extension, hopefully YOU have complete confidence in how things landed with your return this year. (If not, please do send me an email, and we can set up a time to discuss.)

But what about your friends?

Tax Freedom Day And Amended Tax Returns For Louisville Taxpayers

“Friendship is like money, easier made than kept.” -Samuel Butler

Our Louisville clients who filed with us this year already feel the peace-of-mind that they were able to claim every possible deduction which is legally allowed in the tax code for 2016. After all, we put each return through an extensive review process to ensure you keep as much of your hard-earned income as the IRS allows.

But what about your friends? And what about your previous years?

Well, since the filing deadline has already passed, they (and you) might think that the proverbial “fat lady” has sung on 2016 returns (and 2015 and 2014). Not so.

Because according to the most recent report on the matter, issued by the General Accounting Office, taxpayers overpay the IRS over $1 billion every year due to incorrect itemization and preparation.

What’s worse is that those who prepared their own taxes (with a software or on their own) are the most vulnerable, according to the report. But did you also know that taxpayers who used one of the “big chain” preparers are almost as bad off?

An excerpt from an additional report from the GAO: In a Limited Study, Chain Preparers Made Serious Errors

In GAO (United States “Government Accountability Office”) visits to chain preparers, paid preparers often prepared returns that were incorrect, with tax consequences that were sometimes significant. Some of the most serious problems involved these preparers…

1. Not reporting business income in 10 of 19 cases;

2. Failing to take the most advantageous post-secondary education tax benefit in 3 out of the 9 applicable cases; and

3.Failing to itemize deductions at all or failing to claim all available deductions in 7 out of the 9 applicable cases.

More clippings from the report:

* The 19 paid preparers we visited arrived at the correct refund amount only twice. On 5 returns, all for the plumber, they understated our refund amount by a total of $3,465.

* All 19 of our visits to tax return preparers affiliated with chains showed problems. Nearly all of the returns prepared for us were incorrect to some degree, and several of the preparers gave us very bad tax advice, particularly when it came to reporting non-W-2 business income. Only 2 of 19 tax returns showed the correct refund amount, and in both of those visits the paid preparer made mistakes that did not affect the final refund amount.

So what can your friends do about this? And what could YOU do about it, if you didn’t have us handle your taxes in prior years? Simple: file an Amended Tax Return.

Many tax businesses don’t provide this service, but even though we’ve completed our clients’ returns, we WILL review any of your friends’ returns — at no charge.

Warmly,

Kevin Roberts

(502) 426-0000

Roberts CPA Group